The Problem

As the world grapples with the dual challenges of rapidly growing populations and shrinking arable land, the need for innovative agricultural solutions has never been more critical. Urbanisation, climate change, and the degradation of natural resources threaten traditional farming practices, leading to food security concerns across the globe. Vertical farming emerges against this backdrop as a beacon of hope, addressing these pressing issues by reimagining how we cultivate crops. This modern agricultural technique promises to revolutionise food production, offering a sustainable path forward as we strive to feed an estimated 9.7 billion people by 2050.

The Solutions

Vertical farming is an agricultural approach that has captivated the attention of farmers, investors, and policymakers in recent years. Traced back to Dickson Despommier’s 1999 proposal, the technique has garnered significant interest, sparking debates about its potential and longevity.

Despite the enthusiasm, the journey to success within this sector has proven arduous for many enterprises, revealing a host of formidable obstacles. However, the underlying vision remains transformative. With crops grown in layered structures, this method holds the allure of:

1. Efficient Land and Resource Utilisation: By stacking crops vertically in controlled indoor environments, vertical farms can achieve significantly higher crop yields compared to traditional methods. Utilising limited urban space for farming could revolutionise food production in densely populated areas.

2. Year-round Crop Production: Overcoming seasonal limitations, vertical farming offers the promise of consistent crop yields throughout the year. Artificial lighting and advanced climate control technology ensure optimal growing conditions, reducing vulnerability to external disruptions and enhancing food security.

3. Reduction of Environmental Impact: Vertical farming’s resource-efficient systems minimise water usage and pesticide needs, while its proximity to urban centres reduces carbon emissions associated with transportation. By curbing deforestation and preserving natural ecosystems, vertical farming contributes to biodiversity conservation with a lower land usage footprint.

The Tech in a nutshell

Vertical farming is categorised into three main segments: Methods, Crops, and Integrated Technologies.

The foundational methods of vertical farming include Aeroponics, Aquaponics, and Hydroponics, with Hydroponics leading the way in terms of adoption. Its superiority stems from the simplicity of its setup, water and nutrient efficiency, and the precise control it offers over the growing environment. Although Aquaponics and Aeroponics offer unique benefits, they have not achieved the same level of market acceptance as Hydroponics due to their comparative complexities and lower efficiencies.

Regarding the variety of crops grown in vertical farms, the focus is primarily on high-value leafy greens, herbs, and certain fruits. While medicinal crops like cannabis are also viable, this analysis concentrates solely on food crops, which are the mainstay of vertical farming produce. There are currently no commercially available staple crops being grown, but research is well underway.

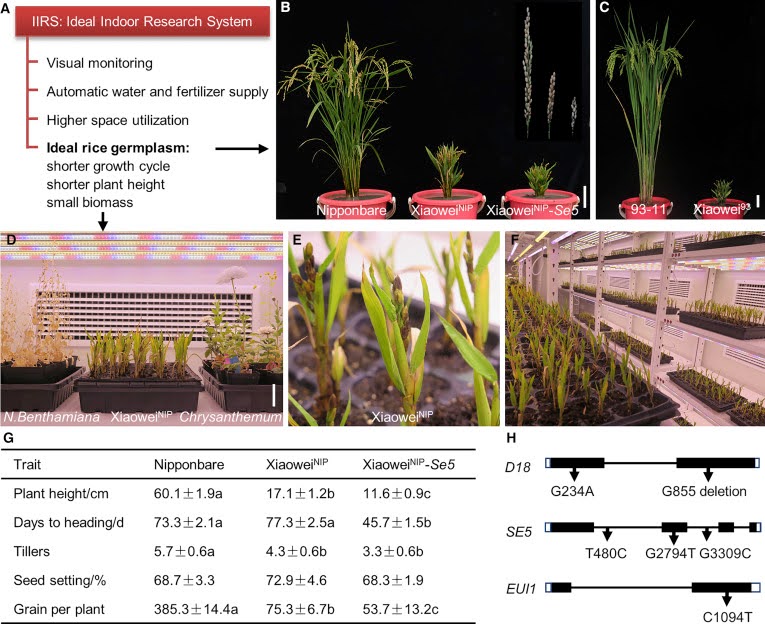

Examples of current dwarf rice varieties being grown

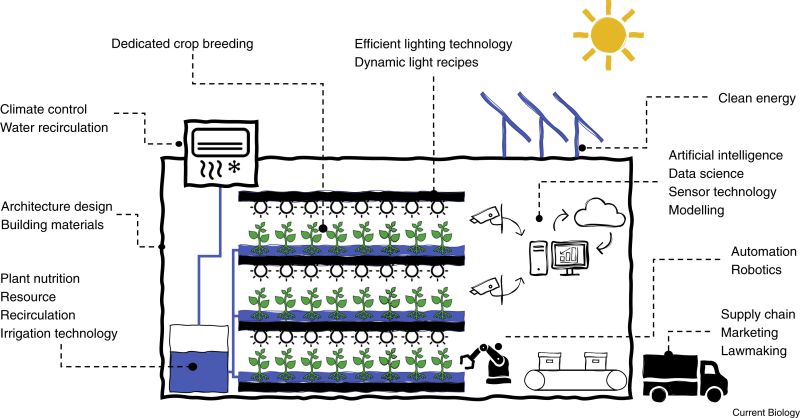

Integrated Technologies play a crucial role in the success of vertical farming operations. This segment encompasses the essential components required for optimal growth and yield, including advanced lighting, irrigation, fertigation, climate control, sensors, artificial intelligence, robotics, energy solutions, and advancements in genetics and breeding. Together, these integrated technologies facilitate a controlled, efficient, and sustainable farming environment helping improve the bottom line of operators by increasing productivity.

Diagrammatic example of integrated systems

The Obstacles

The industry faces significant challenges, the least of which is competing with established and heavily subsidised players in the wheat, rice and potato industries. A more immediate and pressing problem for the sector is negative cash flows and limiting burn while the industry matures. With high Capex and COGs, the main challenges are economic in nature:

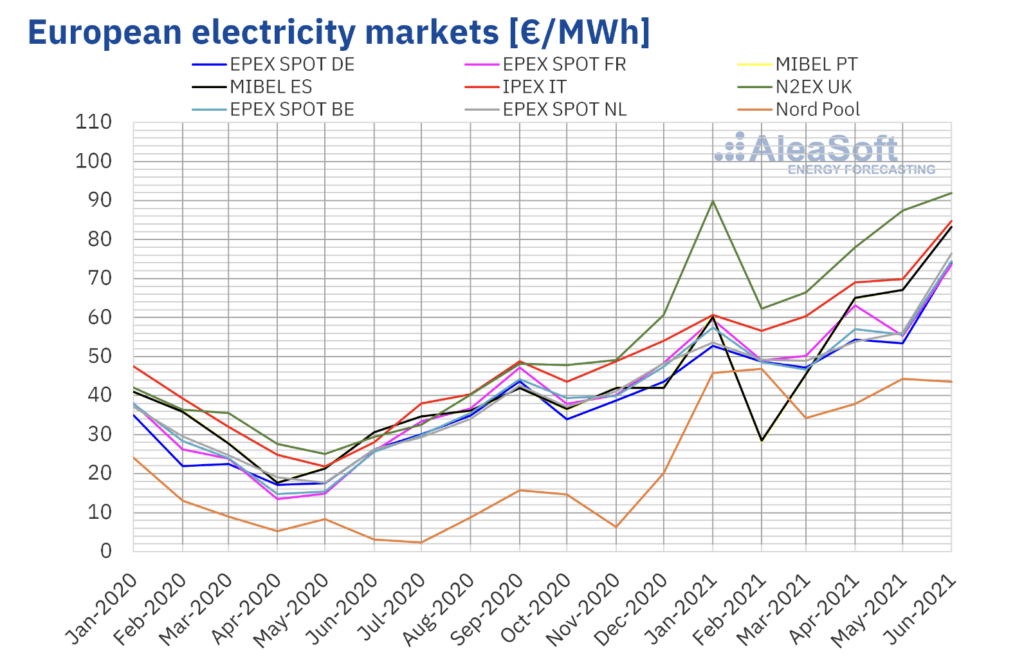

Powering Progress: Navigating Huge Electricity Bills

Vertical farming’s reliance on artificial lighting and advanced technologies can lead to significant electricity consumption, resulting in soaring energy bills. As the industry strives for sustainability, finding energy-efficient solutions becomes imperative. Innovations in renewable energy sources and improved LED technology are promising steps towards mitigating this challenge and reducing the environmental impact of vertical farms.

EU Electricity prices

Balancing Costs: Managing Building Rents versus Field Rents

The cost of renting indoor spaces for vertical farming often surpasses that of traditional field rents. To counter this, some companies are offering a unique subscription model, allowing businesses to have food grown on their commercial premises. This approach enables urban establishments to enjoy the benefits of fresh, locally sourced produce without the burden of high building rents, making vertical farming more accessible and economically viable.

Striking a Technological Balance: The High Capex of Automation

Achieving cost efficiencies in vertical farming requires embracing automation, which demands substantial initial investments. Cutting-edge software, robotics, and energy-efficient LED lighting are among the key elements in optimising vertical farm operations. Balancing these expenses with potential long-term benefits and increased yields is a crucial consideration for the industry’s growth and viability.

Compounding this is the lack of commercially viable staple crops, such as potatoes, wheat or rice which are needed for larger scale adoption. There is ongoing research into compatible species.

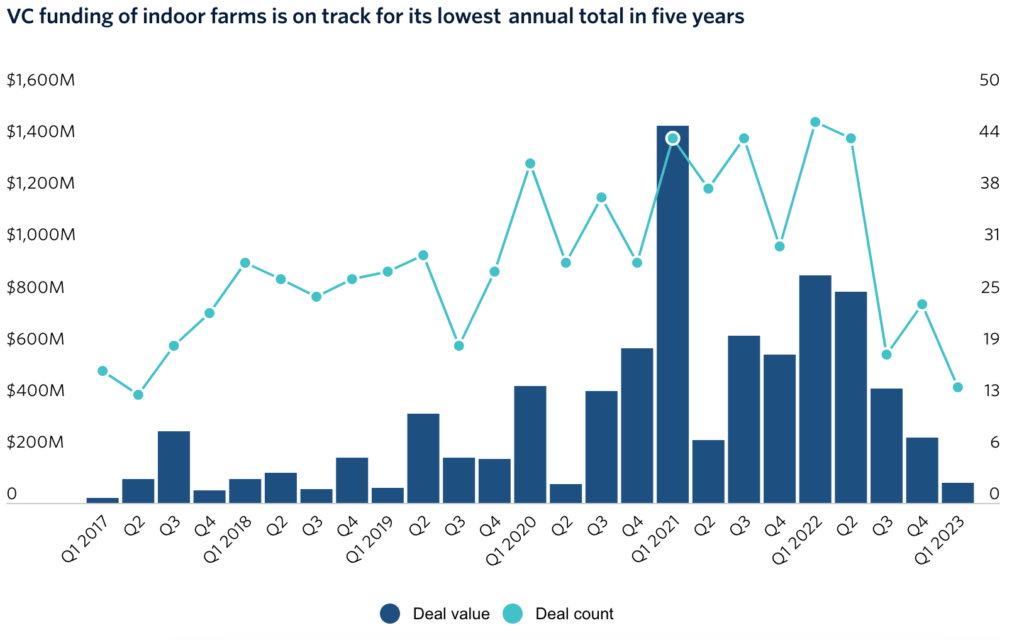

Investments and Market Dynamics

In December 2021, indoor farming emerged as the frontrunner in agricultural technology investments, attracting a staggering $1.7 billion. This surge underscored a burgeoning interest in the sector’s potential. Yet, the landscape shifted as the initial bubble of venture capital funding burst, leading to a re-evaluation of strategies and expectations within the indoor farming community.

What we see now in the wake of this collapse are a glut of hydroponic salad producers who are cash neutral, but lacking the R&D budgets to further innovate outside of high value gourmet foods and into the staple crop markets, where they will need to find cost parity with traditional farming methods to have any sort of meaningful impact on the environment.

Each failure has offered important lessons on energy independence and the innovation of hybrid systems. Utilising direct or indirect sunlight through photovoltaic (PV) panels and storage, the sector is moving towards sustainability and operational efficiency. The development of genetically optimised crops for indoor conditions by pioneers like Infarm and Temasek Life Sciences Laboratory highlights a focus on enhancing yields and sustainability.

Adopting the lean and efficient Dutch Greenhouse Business Model, the indoor farming industry is redefining its operational blueprint. By minimising staff overheads, outsourcing non-core functions, and empowering facility managers with multiple roles, including head grower responsibilities, indoor farms are significantly reducing their overhead costs. This streamlined approach, coupled with lessons learned from past setbacks, is setting the stage for resilient and sustainable companies.

Startups Within the Field

Infarm specialises in in-store and modular vertical farming systems, emphasising the direct integration of farms within consumer spaces like supermarkets. They leverage IoT and AI to optimise crop growth, placing themselves at the intersection of production and retail within the vertical farming value chain.

Seasony.io focuses on automating vertical farming operations with robotics to enhance efficiency and scalability. Their technology targets labour reduction and operational optimisation, positioning them as key enablers of production efficiency in the vertical farming ecosystem.

Netled.fi provides integrated solutions for vertical farming, including advanced LED lighting and climate control systems. Their technology, centred around the Vera® platform, aims to maximise plant growth efficiency and sustainability, making them pivotal in supporting the infrastructure and technology development segment of the value chain.

The Road Ahead

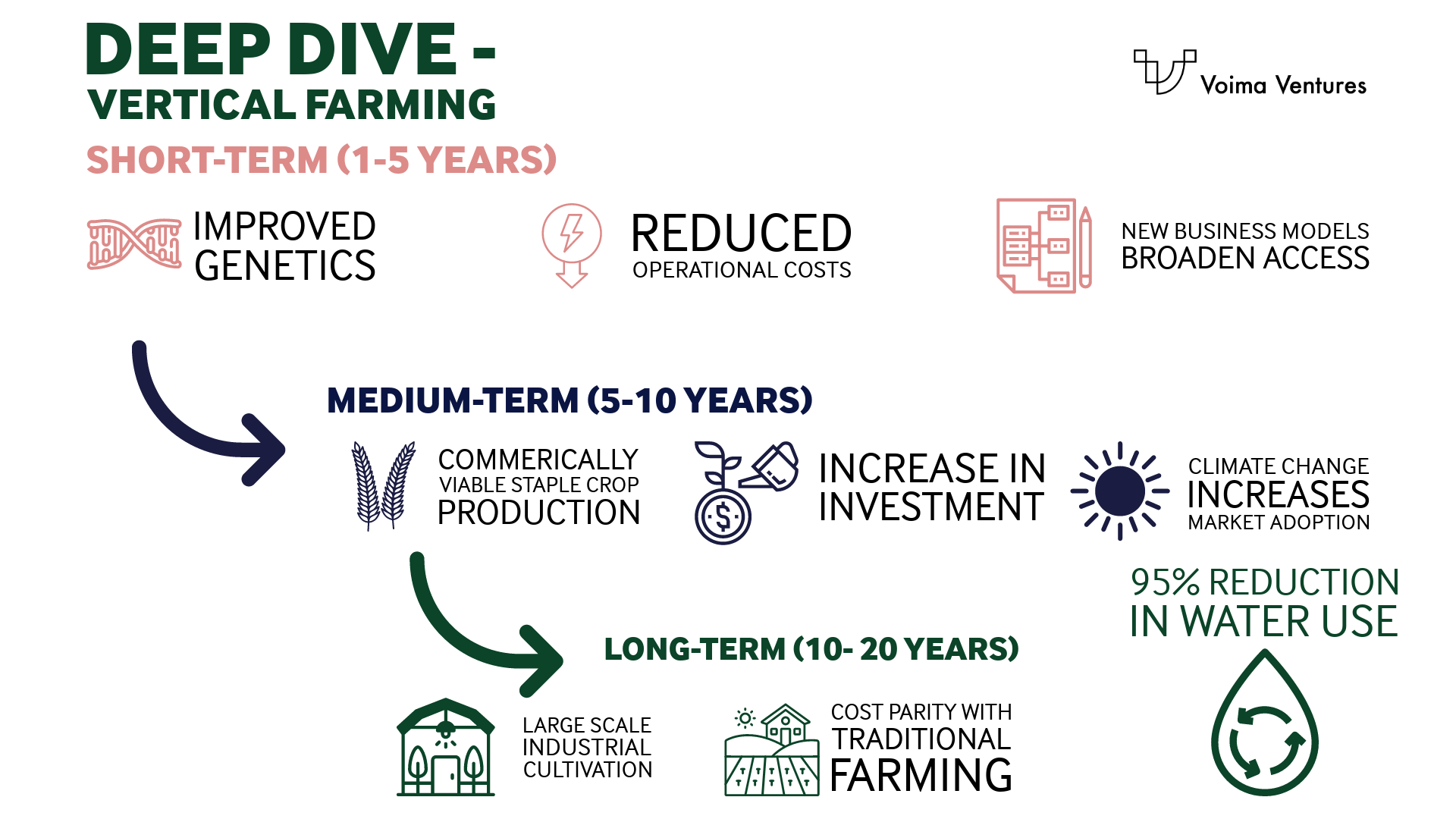

The journey towards integrating staple crop cultivation into vertical farming is not without its challenges, but significant progress is expected in the coming years. While specific timelines may vary depending on research breakthroughs, investments, and regulatory developments, some key milestones can be anticipated.

Short-term (1-5 Years)

- Capitalise on R&D for higher yields and resource efficiency.

- Employ AI to streamline operations and energy consumption.

- Create flexible business models for wider vertical farming adoption.

Medium-term (5-10 Years)

- Adapt crops genetically for indoor cultivation success.

- Propel market expansion as climate concerns intensify.

- Trial staple crops indoors to validate their economic viability.

Long-term (10-20 Years)

- Establish industrial-scale cultivation of key crops indoors.

- Achieve price parity with open-field farming via innovation.

- Seek government backing for sector-wide sustainable growth.

Catalysts for Disruption

Extrinsic catalysts in vertical farming are becoming increasingly evident, as global warming exacerbates droughts and renders outdoor crop cultivation riskier and therefore more costly, as we have recently seen with olive oil, cocoa and grape production. Furthermore, the downturn in commercial property prices is reshaping the economic landscape of indoor farming, making it more competitive with traditional agriculture in terms of land costs. This convergence of environmental challenges and economic shifts may position vertical farming as a viable, sustainable alternative for future food production. It would be logical to assume that we will see the greatest adoption in areas and countries that suffer most from water shortages and food security issues.

Conclusions

Key milestones in this sector will also be influenced by government policies and international initiatives that prioritise sustainable agriculture and food security, like we currently see in Singapore. Public-private partnerships will play a crucial role in supporting research, development, and the implementation of vertical farming technologies. The willingness of governments and industries to embrace this agricultural approach will determine the speed of its expansion and impact on communities.

Looking ahead to the future of vertical farming, it becomes evident that its potential to revolutionise sustainable and locally sourced food production is vast. However, a critical obstacle must be addressed for vertical farming to successfully cultivate staple foods in the next decade: the challenge of scaling up production to economically viable levels.

Yet, amid this optimism, a peculiar and uncomfortable thought arises. In this environment, devoid of bees, insects, or even wind, how do we pollinate the plants whose fruits we rely upon for sustenance? The prospect of AI and robots taking up the role of pollinators could potentially replace the age-old contributions of bees. As we navigate the path towards vertical farming’s bright future, we must grapple with these implications and find sustainable solutions that balance technological advancements with ecological integrity. The harmonious coexistence of innovation and nature will be essential as we embark on this transformative journey.