Sustainable Fuels, Sustainable Future: The Impact of Next-Generation Biofuels

The quest for sustainable energy sources has intensified in the face of environmental concerns and the limitations of first-generation biofuels. First-generation biofuels, derived from food crops, have faced criticism for their competition with food resources, land-use changes, and modest reductions in greenhouse gas emissions. In contrast, next-generation biofuels, produced from non-food feedstocks like agricultural residues, algae, and waste materials, offer a promising alternative. These advanced biofuels aim to minimise the side effects of biofuel production, such as land competition and greenhouse gas emissions, while maximising petroleum displacement. The urgency is underscored by the transportation sector, which emits 3.5 billion tonnes of CO₂ annually, with companies like Maersk seeking significant emissions cuts through biofuels for sectors where decarbonization strategies like electrification are challenging.

The Tech in a nutshell

Next-generation biofuels represent a class of renewable fuels derived from sustainable carbon sources, including agricultural residues, dedicated energy crops, waste materials, and green hydrogen. These biofuels are designed to address the environmental and ethical concerns associated with their predecessors by offering a sustainable, efficient, and versatile alternative to fossil fuels.

Advancements in Biofuel Technologies and Applications

Lignocellulosic Biomass and Waste Materials: Utilises plant materials and waste for biofuel production, reducing competition with food crops and managing waste. Carbon Neutral.

Algae and Aquatic Plants: Exploits the high oil content and rapid growth rates of algae, offering a potent source for biodiesel and biojet fuel. Carbon neutral

Green Hydrogen: Involves the synthesis of green hydrogen through electrolysis run by renewable sources rather than gas powered, steam methane reforming. Carbon agnostic.

The Value Chain

The value chain for next-generation biofuels spans from feedstock cultivation and collection, through processing and conversion, to distribution and end use. The biggest challenge facing bio fuels is sourcing enough input materials to scale production and eventually satisfy global demand.

Feedstock Sourcing: Diverse sources range from lignocellulosic biomass (e.g., corn stover, wheat straw) to algae and municipal solid waste. For instance, Neste has expanded its feedstock base to include waste and residues, reducing reliance on food crops.

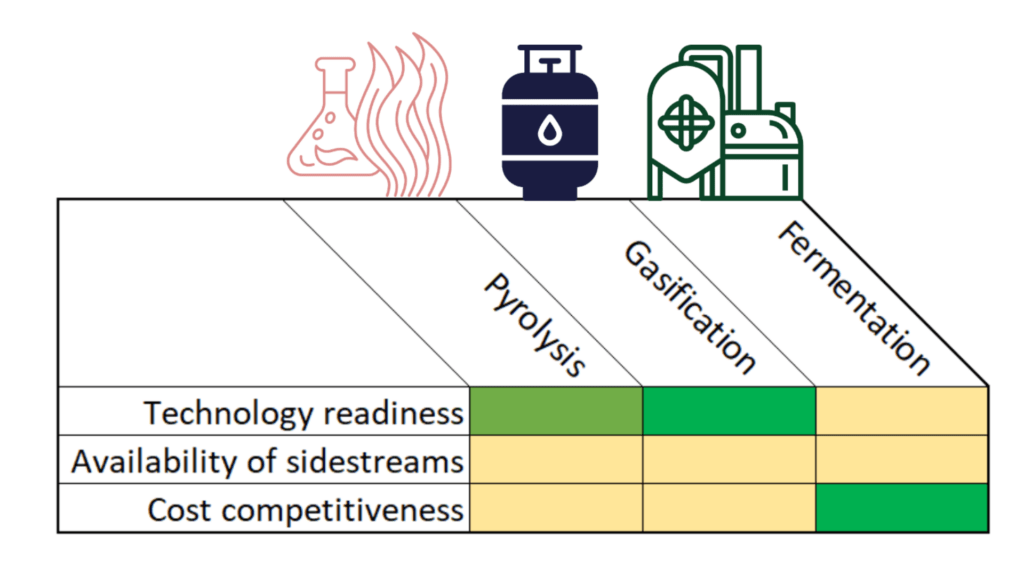

Conversion Technologies: Technologies like gasification, pyrolysis, and enzymatic hydrolysis convert biomass into biofuels. Enzymatic hydrolysis, for example, breaks down cellulose into sugars that can be fermented into ethanol, offering a more efficient utilisation of biomass.

End-Use Applications: Advanced biofuels are utilised in sectors where carbon reduction is crucial, such as transportation. Maersk, for instance, is exploring drop-in biofuels that require no modifications to existing vessels, providing an immediate reduction in carbon emissions for the maritime industry.

Investments and Market Dynamics

Investment in next-generation biofuels is pivotal for scaling up technologies and meeting global energy demands. The biofuels market is anticipated to grow from $110 billion in 2021 to $201 billion by 2030, highlighting the sector’s growth potential. Significant investments include:

R&D Funding: Governments and private entities invest in research to improve biofuel production efficiency. For example, the European Union has supported biofuel projects through its Horizon 2020 program, allocating millions of euros to innovation in bioenergy.

Commercial Scale-up: Companies like Neste are investing heavily in increasing production capacities. Neste’s renewable product capacity, for instance, grew to 3.3 million tons by 2022, with plans to double by 2026.

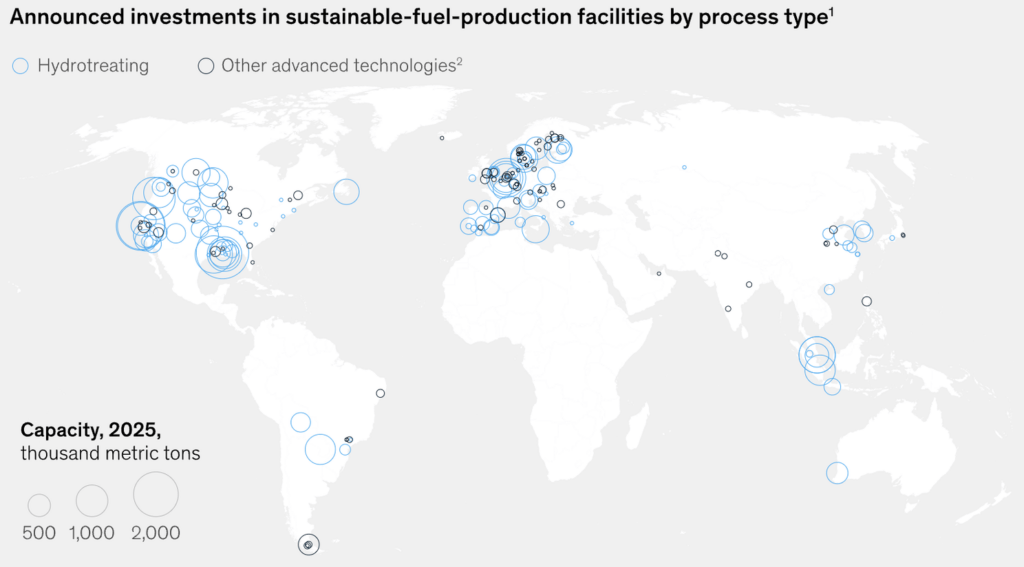

VC Investments: Investments in sustainable fuel facilities are increasing in Europe and the USA, with McKinsey estimating the need for and additional $1-1.4 trillion of investment by 2040 to satisfy regulated demand. This highlights a critical need for innovation in using diverse raw materials, opening significant opportunities for startups across all parts of the value chain.

Source: “McKinsey & Company” – Charting the global energy landscape to 2050: Sustainable fuels

Startups Within the Field

Startups play a crucial role in innovating within the biofuel industry. Examples include:

Origin by Ocean (ObO): Focuses on upcycling harmful algae into valuable products, demonstrating the potential for leveraging aquatic biomass for high-value products beyond biofuels. They have successfully produced bio fuel on a small trial scale.

P1 Performance Fuels: Specialises in the commercialisation of e-fuels, with plans for up-scaled production by 2029. Their work represents the forefront of converting green hydrogen and CO2 into liquid fuels compatible with existing infrastructure.

Liquid Wind: The Swedish startup is converting renewable electricity and biogenic CO2 from biomass power plants into climate neutral liquid eFuel, and more specifically eMethanol. Liquid Wind facilities offer hard-to-abate sectors, such as global shipping, an opportunity to accelerate their transition to fossil-free propulsion.

Catalysts for Disruption

Regulatory support is essential for the biofuel industry’s growth. Policies like the Renewable Fuel Standard (RFS) in the United States mandate the blending of renewable fuels into the fuel supply, driving demand for biofuels. Additionally, carbon pricing mechanisms incentivise the reduction of greenhouse gas emissions, making biofuels more competitive with fossil fuels. The European Union’s Renewable Energy Directive (RED) sets targets for renewable energy usage, including biofuels, promoting their adoption across member states.

The Road Ahead

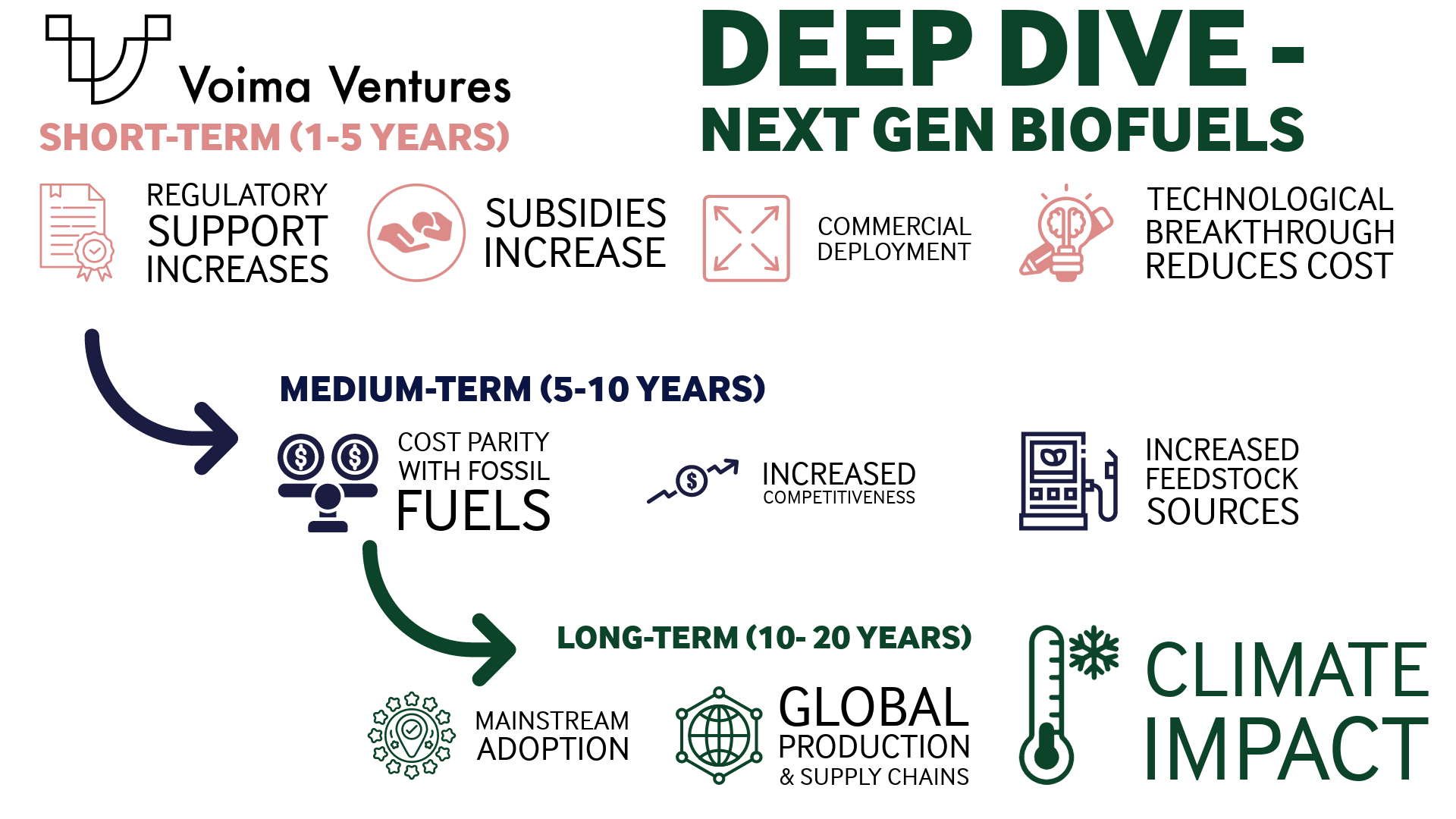

Short-term (1-5 Years)

– Increase in Regulatory Support: Strengthening of national and international policies to boost biofuel adoption and production.

– Technological Breakthroughs: Enhancements in conversion technology and feedstock processing to lower costs and improve efficiency.

– Initial Commercial Deployments: Launch of pilot and commercial-scale projects, targeting niche markets like aviation and heavy transport.

Medium-term (5-10 Years)

– Cost Parity with Fossil Fuels: Technological advancements and scale economies reduce biofuel costs to match or undercut fossil fuels.

– Broadening of Feedstock Base: Diversification into algae, waste materials, and non-food biomass to minimise environmental impact.

– Drop in consumer costs and shift in taxation drive widespread adoption outside of initial niche applications.

Long-term (10-20 Years)

– Mainstream Adoption: Integration of next-gen biofuels into the global energy mix for transportation, industry, and power generation.

– Global Production and Supply Chains: Establishment of robust supply chains for biofuel feedstocks and fuels, enhancing energy security.

– Significant Sustainability and Climate Impact: Major contributions to greenhouse gas reduction, climate change mitigation, and promotion of a sustainable, circular energy economy.

Conclusions and what’s next?

Technological and Market Growth: Advances in technology and an expanding market are driving the development of next-generation biofuels. These biofuels are poised to play a significant role in reducing greenhouse gas emissions and offering sustainable alternatives to fossil fuels, particularly in hard-to-decarbonise sectors.

Need for Continued Innovation and Investment: Sustained research and development, along with substantial investment, are critical for overcoming current production challenges, achieving cost parity with fossil fuels, and ensuring a diverse and sustainable feedstock supply. There are many leading initiatives within Nordic universities and research institutions, and venture capital investors should keep a close eye on advancements and innovations coming out from these facilities.

Regulatory Support and Global Adoption: Strong regulatory frameworks and international policies are vital for promoting the adoption of next-generation biofuels. In the long term, these biofuels are expected to become a mainstream component of the global energy mix, contributing significantly to climate change mitigation and a more sustainable energy economy.

A challenge for startups is finding a business model that can lead to a massive value growth without a need for equally massive CAPEX investments. Emphasising a lean business model is crucial when bringing new innovations to the energy sector. Startups can bring about a massive change to the market. They need, however, to find the opportunities where progress is not dependent on building massive factories competing with existing refineries.

Market Study by Pontus Stråhlman, Article by Cameron Murphy