The Future of Sustainable Meat Consumption?

As global meat consumption is set to rise by 14% to nearly 400 megatons per year by 2030, the focus on sustainable meat production has never been more critical. High-income countries are increasingly opting for healthier choices and high-value cuts, while developing nations are favoring poultry and pork, with a growing demand for premium cuts. This growing appetite presents a significant environmental challenge, as traditionally produced meat contributes to deforestation, biodiversity loss, water scarcity, and global warming.

The Tech in a nutshell

In response to these environmental concerns, alternative solutions are emerging. Plant-based meats, mushrooms, pulses, soy, and legumes relatively rich in protein offer some relief, but they come with their own set of challenges, including differences in taste, texture, and their own environmental footprint. Cultivated meat has been proposed as an alternative solution. Though still in its nascent stages, regulatory approval for cultivated meat has recently advanced (most notably with the FDA approving commercial sales of Upside Foods and Good Meat’s produce in June 2023), and costs have been gradually decreasing. Yet, significant optimisation and development from adjacent verticals such as bioengineering and raw material supply are required to make it a viable mass-market option.

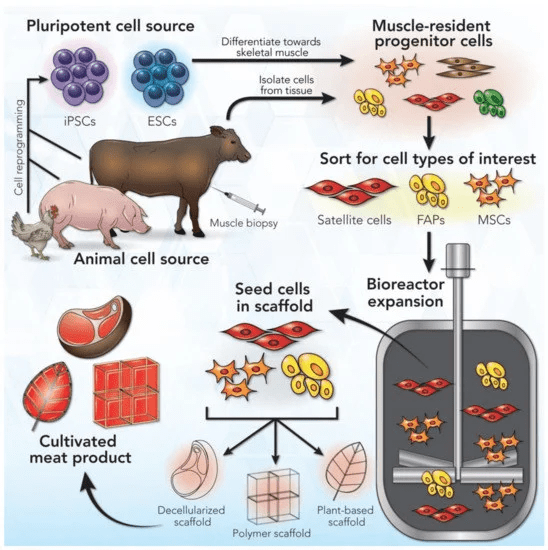

A short diagram showing the valorisation process

The Obstacles

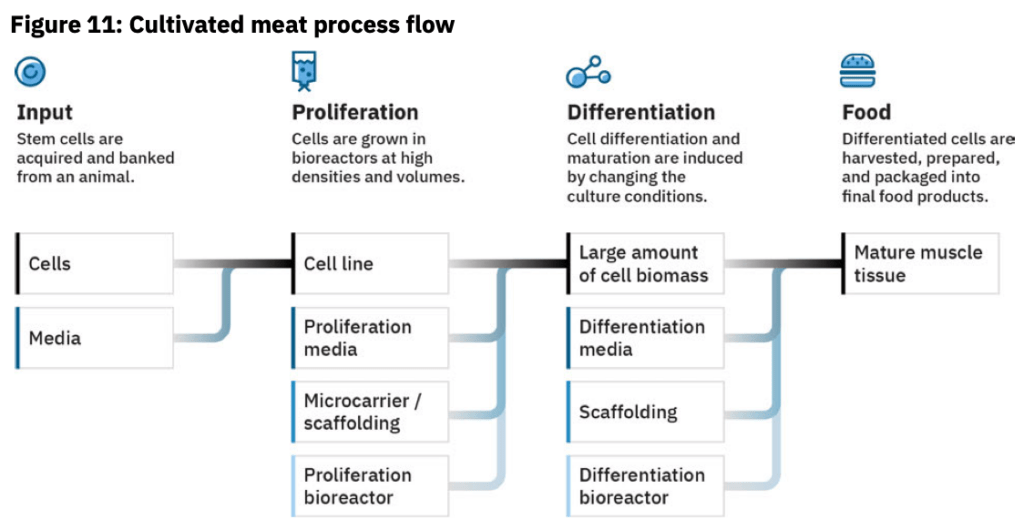

One of the major challenges in producing cultivated meat is the cost associated with cell cultivation, primarily due to the high price of amino acids and recombinant proteins. Additionally, creating a natural environment for cell growth requires sophisticated control mechanisms, which further increase production costs. As a result, more straightforward products like unstructured meats and hybrid products hit the market first. Still, advancements in consumer value discussions and regulations are required.

The cultivated meat market faces various controversies that need resolving before it can achieve widespread consumer adoption. Young consumers might be more open to trying cultivated meats, but for them to become repeat customers the industry needs to address concerns related to safety, health, and taste. Culturally, the acceptance of cultivated meat as halal or kosher is still under debate, and there’s a question of whether vegetarians or vegans would consider incorporating it into their diets.

Process flow chart showing the many different cost accruing stages of production.

Investments and Market Dynamics

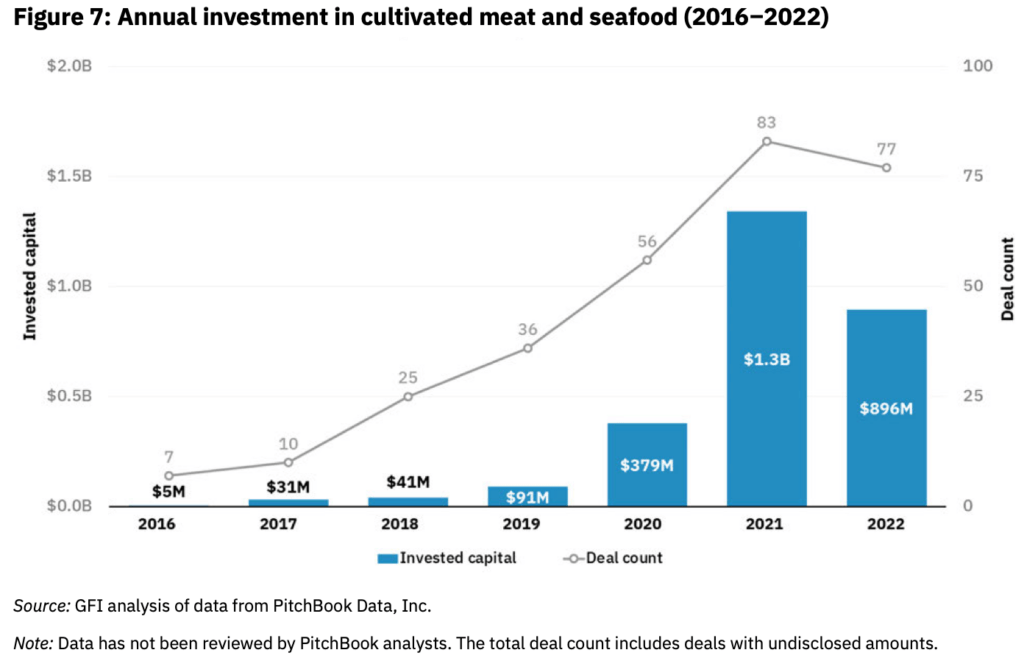

Despite these challenges, the cultivated meat industry is drawing attention. The market is expected to reach around $2 billion by 2030, with a number of pilot-scale production facilities already operational. However, scaling up cultivated meat production requires substantial capital investment. The economic environment has been challenging, with investments in the field dropping significantly from 2021 to 2022, and a further decline for 2023 is expected as capital has become tighter. Not to mention the dependency on production input from culture media to bioprocessing hardware from companies like Merck and Cytiva. Their innovation capabilities and supply availability directly affect the cultivated meat industry.

GFI Analysis of data from PitchBook Inc.

Startups Within the Field

Cultivated meat companies are not only innovating in food production but also becoming significant customers to biotechnology giants and emerging players in the multi-billion dollar markets of pharmaceuticals, agriculture, consumer goods, and energy. However, the industry is still in its early stages, with high returns on investment yet to be realised. Some notable companies active in the space:

- Omeat: Produces cultivated meats for consumers who want the taste of real meat without the cruelty of animal suffering.

- Ark Biotech: Producing the Bio-reactors needed to scale cultivate meat productions.

- ÄIO: Producing replacements for animal fats and oils, and essential component of getting cultivated meats to “meat” consumer expectations

Catalysts for Disruption

As the regulatory landscape continues to evolve, with notable advancements in the US and varying responses in the EU, the cultivated meat industry faces a critical juncture. To convince investors and consumers, and achieve scalability, it must answer several questions related to price parity with traditional meat, ethical production, and long-term investment returns.

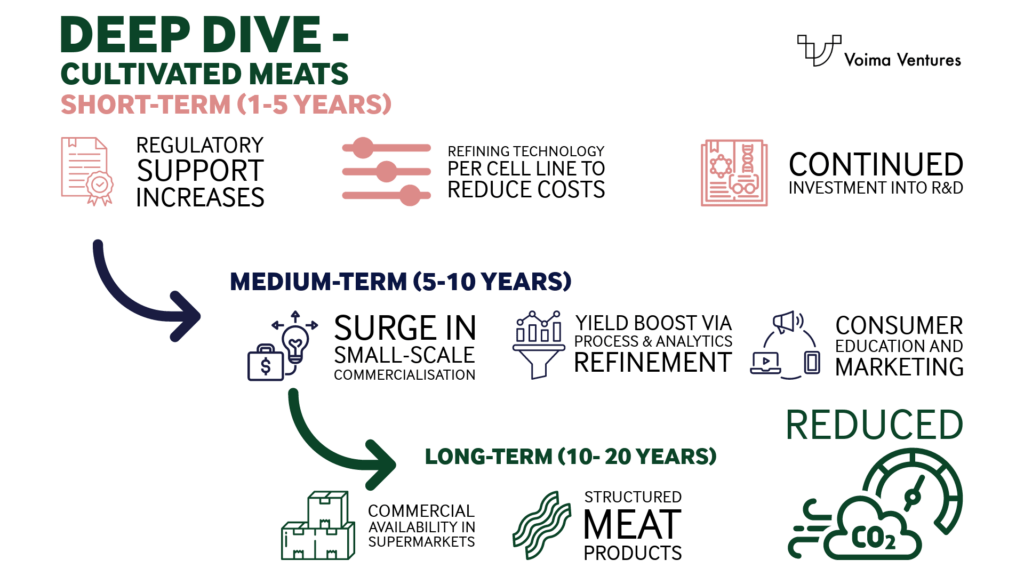

Short-term (Next 1-3 Years):

– Increased regulatory approvals in progressive markets like the US and Asia.

– Focus on perfecting production processes and reducing costs.

– Continued emphasis on research and development.

Medium-term (3-10 Years):

– More efficient production methods and decreased costs.

– Small-scale commercialisation increases in unstructured meats & hybrids.

– Improvements in bioprocessing, monitoring, and analytic tech.

– Critical phase for consumer education and marketing to boost public awareness and acceptance.

Long-term (10+ Years):

– Continued technological advancements & favourable regulatory environments.

– Cultivated meats potentially available on store shelves in various markets.

– Emergence of structured meat products and significant market penetration, targeting urban and environmentally conscious demographics.

What would be a game changer and a big opportunity

Cost-Effective Cell Culture Medium: Innovating cheaper, serum-free culture mediums is crucial to reduce the major costs associated with growth factors and nutrients needed for cell growth.

Bioreactor Design and Efficiency: Advances in bioreactor technology for larger-scale, efficient production are essential, focusing on improved oxygen and nutrient transfer and automated controls to cut labor costs.

Scaffolding Materials and Cell Line Development: Breakthroughs in creating scalable, biocompatible scaffolds for texture and structure, alongside developing fast-proliferating cell lines, can significantly lower production costs and enhance the viability of cultivated meats.

Conclusions

While cultivated meat offers a promising solution to the environmental impact of traditional production, the industry has to navigate a complex array of challenges before it can truly transform our food systems and consumption habits.

Entrepreneurs in turn need to figure out the technical equation from profound cell line understanding to culture media and bioprocess optimisation while navigating the regulatory environment in progress. Moreover, engaging consumers in the process for gaining traction are critical for attracting investors. The choice of headquarters plays a key role in enabling future growth from technical development, regulatory, consumer adoption and investor interest perspectives. Reinventing the wheel or stumbling on outright bans are costly and wasteful ways forward. Navigating the landscape thus requires a great deal of strategic thinking.