A $600 Billion Opportunity Hiding in Plain Sight

Hormonal health is both a silent crisis and a vast economic opportunity. While traditional women’s health markets (e.g. contraception, fertility, menopause) are projected to reach $60 billion by 2027, broader analyses show the total women’s health market could top $1 trillion globally, with hormonal health alone representing an estimated $600 billion segment.

Affecting over *2 billion women worldwide, hormonal care — spanning menopause, menstrual health, and long-term disease risk — remains underfunded and under-researched. Thankfully, momentum is building. Research, startups and us, VCs are now focusing on closing this gap — and the payoff, both human and financial, could be earth-shaking.

The Silent Crisis – due to funding gap in research funding

Nearly half of the world is biologically female — yet hormonal health remains one of the most overlooked, underfunded areas in medicine. Only 5 % of global R&D funding goes to women’s health. From puberty to menopause, hormone fluctuations touch everything from mood and energy to metabolism and fertility. Still, diagnostics, treatments, and clinical research haven’t kept up (Nature).

As an example, the NIH allocated only $56 million to menopause research in 2023, increasing slightly to $58 million in 2024. In Europe, Horizon Europe has no dedicated menopause funding line — instead folding it into broader health programs — with just €12.4 million awarded to a single CVD prevention study in peri‑/postmenopausal women (sources: Nature & Mckinsey).

The consequences of the neglected past decades are widespread. Conditions like endometriosis, PCOS, and perimenopause are often misdiagnosed or entirely missed. Peri-menopause and menopause impacts every woman, and millions of women are left managing life-disrupting symptoms with little guidance or effective support. The system is fragmented, reactive, and ill-equipped to deliver personalised care.

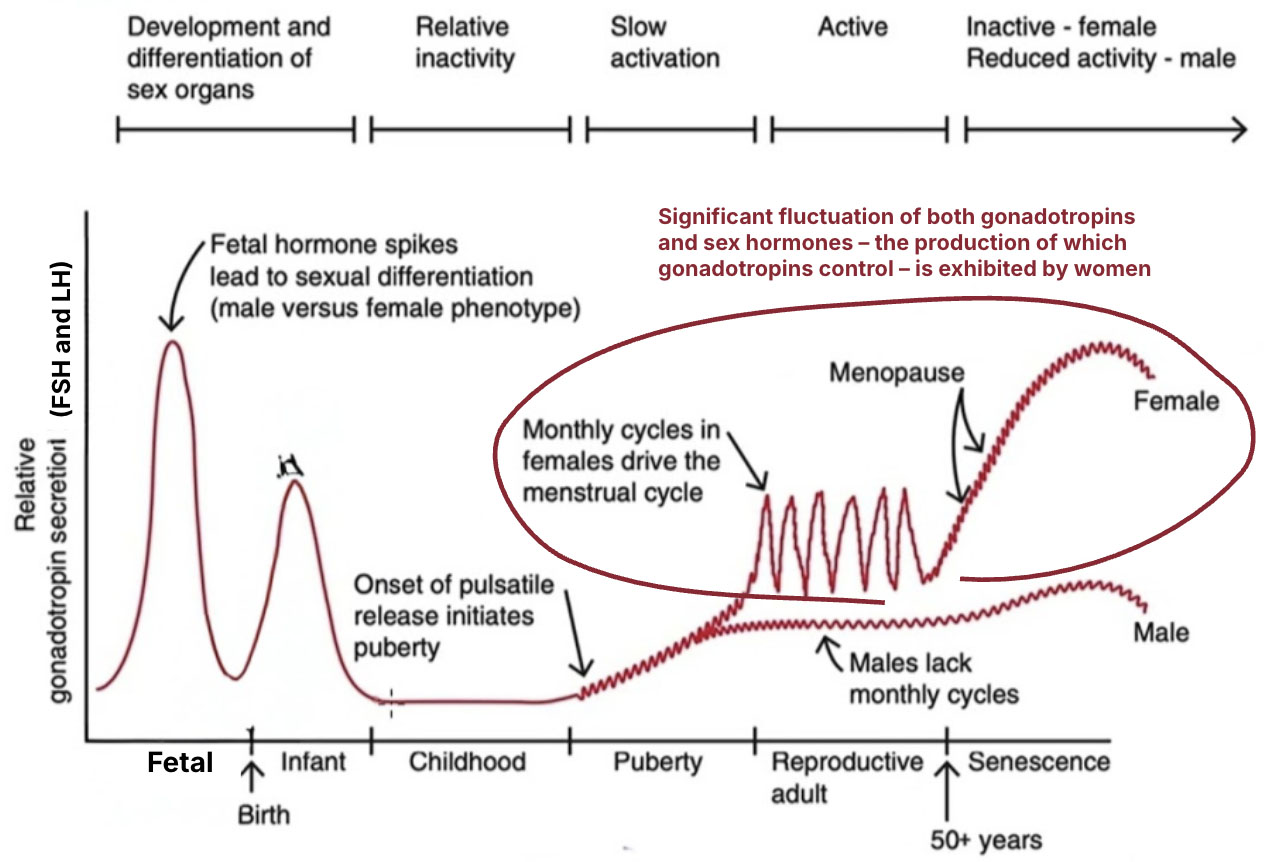

Figure 1: Gonadotropin hormone levels fluctuate significantly throughout women’s lives — a biological reality starkly different from men’s hormonal stability..

(Graph adapted from Kendall Hunt Publishing Company)

A New Hope – A New Wave of Innovation

A new generation of healthtech startups is stepping into the void. From AI-powered cycle tracking apps to at-home hormone tests and digital consultations, as well as biotech innovations and therapies – these tools are making hormonal health smarter, more accessible, and data-driven.

What sets the leaders apart? Science bases precision diagnostics, personalisation, and continuous tracking — all seamlessly integrated into platforms that also connect users to clinical professionals. These tools aren’t just empowering individuals — they’re feeding real-world data into the broader healthcare ecosystem. Together, they aim to shift hormonal health from symptom management to data-driven, proactive care

The Tech That’s Changing the Game

At the core of the movement is better data: how we collect it, interpret it, and act on it – while having a scientifically proven and safe validation. Advances in biosensing and home testing are making hormone tracking easier than ever — no lab visits required. Combined with structured user input and AI analytics, platforms can deliver insights in real-time and inform both personal decisions and professional care.

The next frontier? Integrating this data into electronic health records — enabling smarter, faster, and more consistent clinical decisions which are preventive and personalized. .

Progress is real — but so are the hurdles.

Despite rising interest, hormonal health continues to suffer from systemic underinvestment and lack of knowledge among clinicians and patients. Scientific validation and clinical adoption take time and capital. Many tools fall into regulatory grey zones: not classified as medical devices, but still shaping user decisions.

Privacy is another critical issue. Hormone data is deeply personal. For platforms to succeed, trust must be earned — not assumed.

Clinically, the field is still catching up. Diagnostic standards often lag behind lived experiences. And without sufficient basic research in women’s health, providers are left without the knowledge base to offer truly comprehensive care.

The Market Signals and Startups to watch

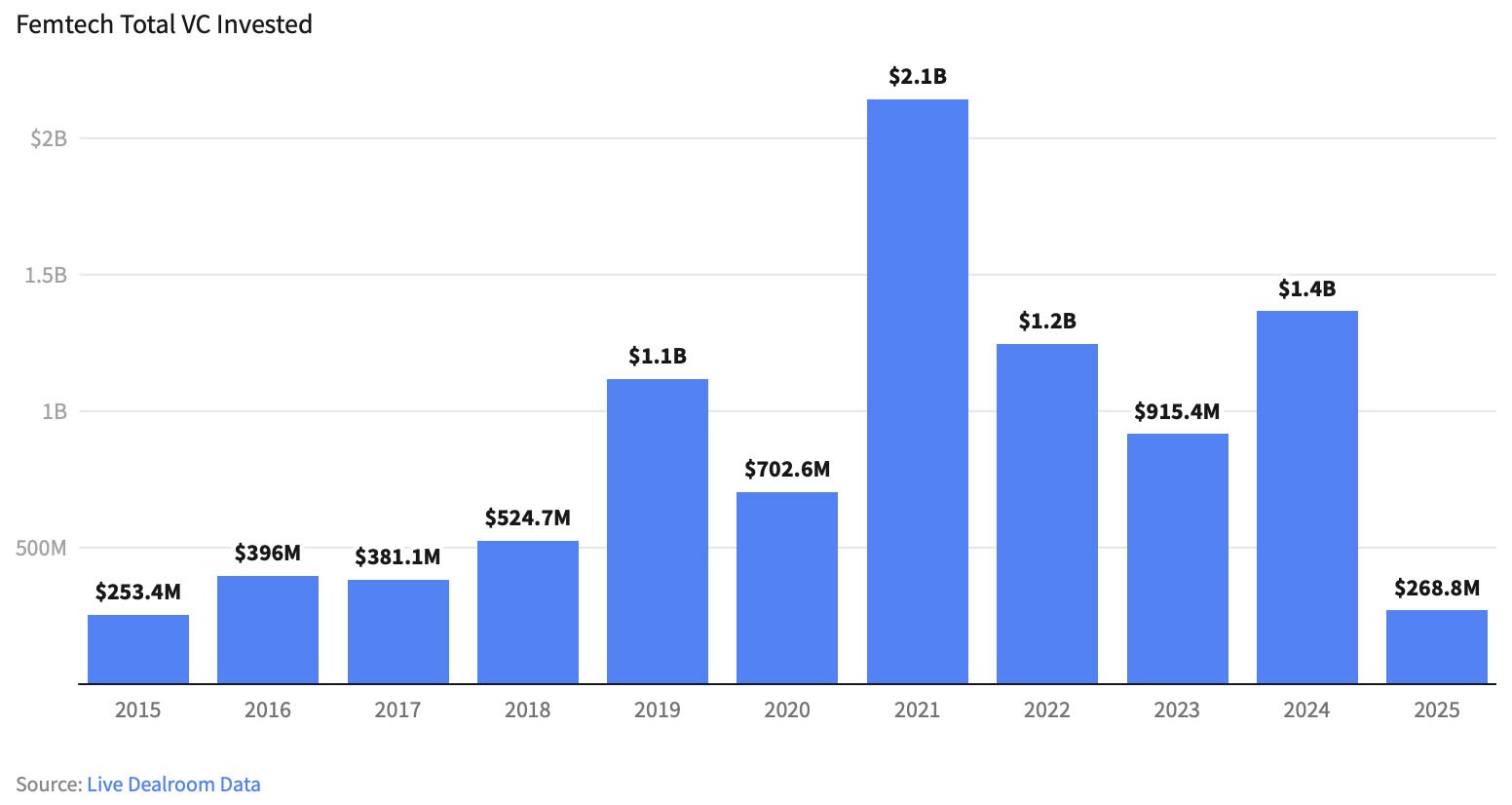

Women’s health is gaining traction — but there’s room to grow. In 2024, femtech attracted $1.4 billion in global VC, representing just 5% of overall healthtech funding. worldhealthexpo.comtheguardian.com

But momentum is building. Platforms that combine diagnostics with ongoing revenue from tracking, education, or clinical services are particularly appealing to investors. As awareness rises, so does willingness to pay — for clarity, control, and outcomes.

Figure 2: Global VC investment in femtech according to Dealroom, data accessed 2.6.2025.

Startups Leading the Shift

Hormona (UK)

Focus: Hormone diagnostics and hormonal health insights

What they do: Offers at-home testing, personalised tracking, and educational content—supporting long-term hormone health.

Why it matters: Combines science-first thinking with consumer-grade UX to serve a neglected need.

Natural Cycles (Sweden)

Focus: Digital contraception

What they do: A non-hormonal, FDA‑cleared fertility tracking solution.

Why it matters: Offers a modern, evidence-backed alternative for women seeking hormone-free birth control.

Inito (India/USA)

Focus: Multi-hormone fertility diagnostics

What they do: Inito provides a smartphone-connected device and urine test strips that measure four key hormones — estrogen, LH, progesterone (PdG), and FSH — offering lab-grade accuracy from home. Its AI-powered app interprets data in real time to track ovulation, confirm hormonal shifts, and optimise fertility.

Why it matters: Inito goes beyond typical ovulation kits with a comprehensive, quantitative approach. Clinically validated platform.

5 Forces Fueling the Hormonal Health Revolution

- Cheaper, Smarter At-Home Diagnostics and Biosensors

Breakthroughs in biosensing are bringing clinical-grade testing home. Companies like Hormona, Oova, and Eli Health offer saliva or urine tests for estrogen, progesterone, and LH, often paired with apps that interpret results in real time. Natural cycles partners with Oura -ring, exampling that emerging skin patches and microneedle samplers promise continuous, non-invasive monitoring. - Smarter AI Models for Hormonal Pattern Recognition

AI excels at spotting subtle, cyclical patterns. It can detect early warning signs of PCOS, thyroid issues, and early menopause. B-to-C tools like Natural Cycles continuously refine predictions and contraceptive accuracy — and new platforms are delivering personalised, on-the-fly health recommendations. - A Cultural and Scientific Awakening Around Menopause and Female Health

Menopause is finally in the spotlight! Updated research—built on re-analysed Women’s Health Initiative data—now shows estrogen can reduce heart disease, bone loss, and cognitive decline when well-timed. Universities are creating midlife health programs, shifting perception, funding, and empowering women to seek proven care. - Bottom-Up Market Pull: Women Driving the Demand

Social media and online communities are creating momentum. TikTok creators are demystifying perimenopause; discussion forums debate cycle syncing. Women are self-educating, demanding alternatives and care, shaping products, and driving development. The rise of biohacking, fertility awareness, and digital health tools reflects this collective empowerment. - Regulatory Momentum and Investor Appetite

Regulators are catching up: FDA clearance for Natural Cycles set a precedent. Initiatives like the European Health Data Space are clearing paths for digital diagnostics. And while femtech still lags (~1-2% of healthtech funding), recent rounds—like $200 million into Flo (valued over $1 billion)—show growing investor confidence (source: ft.com)

What’s Next? A Look Ahead

Near-Term (1–3 Years)

- Surge in D2C hormone testing across Europe and the UK

- Stronger clinical validation and integration with insurers

- Heightened investor interest in menopause, fertility, and tracking tech

- Bundled care models (diagnostics + coaching + supplements)

Mid-Term (3–10 Years)

- Hormone diagnostics become standard in corporate wellness and primary care

- Multi-hormone, multi-biomarker health platforms scale

- Pharma partnerships enable personalised therapies and drug development

- Strategic M&A activity as incumbents enter the category

Long-Term (10+ Years)

- Hormonal health becomes a pillar of personalised medicine — spanning mental health to ageing

- Global regulatory harmonisation springs widespread adoption

- Real-time AI diagnostics shape proactive care

- Inclusive platforms drive equity across all populations in the society and regions

And now: What Could Change Everything?

Standardised, non-invasive, affordable hormone tests with clinical-grade algorithms — making hormone care daily, not a luxury.

A trusted brand offering unified diagnostics, education, and clinical support — moving care from coping to prevention

Bottom Line: A Category Poised for Scale

Hormonal health sits at the intersection of science, consumer demand, and unmet medical need. With deeper data and better tools, care can be revolutionised for millions of women. For investors and innovators, the prize isn’t one app — it’s the infrastructure for personalised, prevention-first medicine.