In a dynamic landscape where Environmental, Social, and Governance (ESG) considerations are driving corporate agendas, Voima Ventures is positioning itself as a catalyst for positive change. We recently embarked on a comprehensive survey of our portfolio companies, and in the interests of transparency and continuing the conversation around the topic, we would like to share some of our results. But first…let’s set the stage.

The latest research from the Finnish Venture Capital Association and PwC reveals an ongoing disparity in gender representation within the boards of VC and private equity companies. In 2022, a mere 13% of board members were women, marking a marginal uptick from the 11% recorded in 2021. That’s an improvement, but it’s only a pinch of salt in the diversity stew.

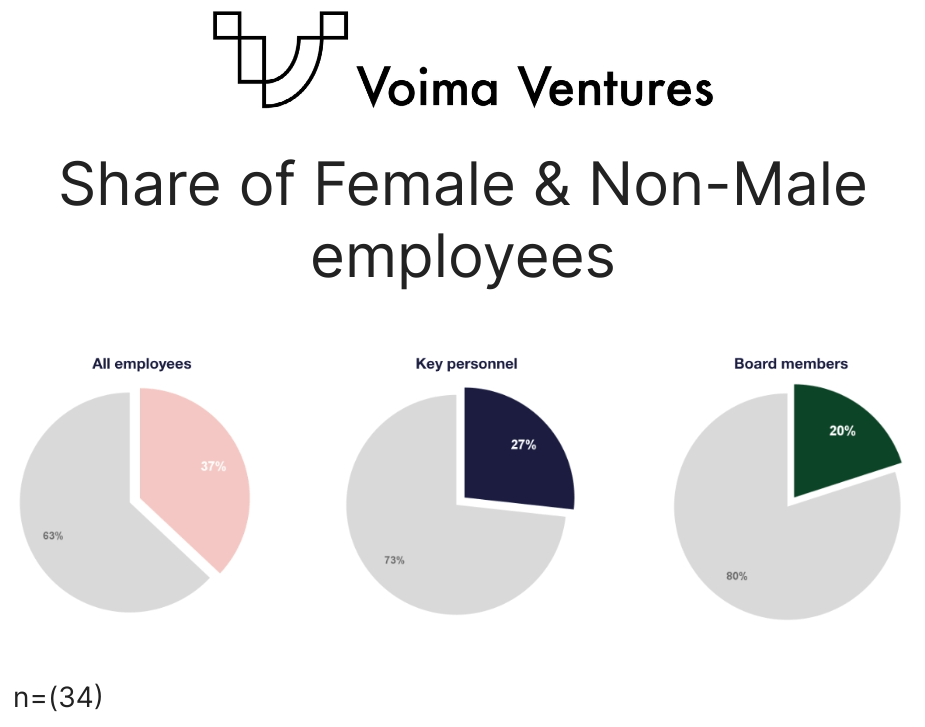

If we contrast that with our own internal findings, we can see that the ascent towards diversity is nuanced, with a disparity between levels of hierarchy. The realm of senior management and board members experiences a diversity deficit compared to the broader workforce. However, progress is palpable. “Key Personnel” and “Female Board Members” register a respective 4 and 8 percentage point surge from 2022 to 2023.

To give some sort of context for the velocity of change, in 2021, 25% of all portfolio company employees identified as female. If we zoom in further, we see that out of the 61 founders in our Fund II portfolio, 13 were women.

Voima Ventures’ performance aligns with trends observed in Sweden, reflecting our active engagement and business operations within the region. A recent Swedish study quoted by PwC Jussi Lehtinen puts the benchmark of women in board positions at 19% in private equity companies. Under this lens, Voima Ventures performance is less radical and more on par with the broader diversity standards of Sweden.

The insights garnered from the Finnish Venture Capital Association and Voima Ventures corroborate this trend, prompting the question: Why does the diffusion of diversity take longer to infiltrate private equity firms as opposed to their publicly listed counterparts? Private equity companies traditionally have a greater appetite for risk and adaptability to change when compared to publicly traded entities.

This core issue appears to arises from partnerships characterised by a disproportionate male presence, subsequently fostering bias in favour of male-dominated boards. The route to diversity entails proactive measures, exemplified by the appointment of independent female board members—an objective championed by Voima Ventures through our “Women to Boards” initiative. These intentional endeavour’s to empower women in decision-making roles not only foster a more equitable and inclusive private equity environment but also usher in a broader spectrum of perspectives and experiences, ultimately benefiting both the companies within our portfolio and society at large.

While these are interesting reflections, the key message that should be highlighted is that progress is being made, albeit slowly. The interplay of education, recruitment practices, and company culture emerges as pivotal factors in shaping inclusivity on a societal level in the coming decade.

If you would like to contribute to diversity in the VC and Deeptech world, Voima Ventures runs an annual “Women to Boards” event, where we match suitable non-male candidates with our portfolio companies. We are currently screening applications, so apply now.